Cryptocurrency has rapidly emerged as a powerful and disruptive force in the financial world. For many, the concept of cryptocurrency can seem daunting, but once you break it down, it’s clear that the principles behind it are both fascinating and innovative. This article aims to explain the inner workings of cryptocurrency, its underlying technologies, and the concepts that support its operation. Whether you’re new to the concept or looking to deepen your understanding, this guide will walk you through how cryptocurrency functions in simple terms.

What is Cryptocurrency?

Cryptocurrency is a form of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies, such as the US dollar or the Euro, cryptocurrencies are decentralized. This means they aren’t controlled or issued by a central authority like a government or central bank. Instead, cryptocurrencies operate on a peer-to-peer network, often using a technology known as blockchain to manage transactions and verify ownership.

Cryptocurrencies are designed to offer an alternative to traditional forms of money, operating independently of banks and other intermediaries. Their decentralized nature ensures that they cannot be easily manipulated or altered by any single entity.

Key Concepts to Understand

Before diving into how cryptocurrency works, it’s important to grasp some of the key concepts that form the foundation of the system:

1. Blockchain

Blockchain is the technology that enables cryptocurrencies to function. At its most basic level, a blockchain is a distributed ledger or database that stores a list of records, known as blocks, that are linked together in a chain. Each block contains a set of transactions, which are verified by the network, ensuring that no one can alter or delete them.

Blockchain is decentralized, meaning there is no central authority controlling the data. Instead, it is stored and validated across multiple computers, or nodes, in the network. This transparency and immutability make blockchain an ideal technology for cryptocurrencies.

2. Cryptography

Cryptography refers to the practice of securing information through encryption. In the context of cryptocurrency, cryptography ensures the integrity and security of transactions. It is used to create public and private keys, which are necessary for sending and receiving cryptocurrency.

A public key functions as an address to which others can send cryptocurrency, while the private key serves as a password that allows the owner to access and manage their funds. Cryptographic techniques also ensure that transactions are secure and that only the rightful owner of a cryptocurrency can use it.

3. Decentralization

One of the most significant features of cryptocurrency is decentralization. Traditional currencies are controlled by central banks or governments, which can influence their value and regulate their supply. However, cryptocurrencies are decentralized, meaning they are not governed by any central authority. Instead, the system is maintained by a network of nodes (computers) that verify transactions and make decisions through consensus mechanisms.

4. Mining

Mining is the process by which new cryptocurrency units are created and transactions are verified on the blockchain. Miners use powerful computers to solve complex mathematical problems, and in return, they are rewarded with new cryptocurrency. This process is essential for maintaining the security and integrity of the network.

The reward for mining often decreases over time as the total supply of the cryptocurrency reaches its limit (e.g., Bitcoin’s cap of 21 million coins). This ensures that the cryptocurrency remains scarce and valuable.

5. Cryptocurrency Wallets

A cryptocurrency wallet is a software application used to store and manage your cryptocurrency. There are two main types of wallets: hot wallets and cold wallets. Hot wallets are connected to the internet, which makes them convenient for regular transactions. Cold wallets, on the other hand, are offline and are often used for storing large amounts of cryptocurrency securely.

Wallets store public and private keys and allow users to send and receive digital currencies. It’s essential to keep your private keys safe, as losing them could result in losing access to your cryptocurrency.

6. Tokens and Altcoins

Bitcoin is the most well-known cryptocurrency, but it is far from the only one. There are thousands of other cryptocurrencies, called altcoins, which offer varying features and use cases. For example, Ethereum is a cryptocurrency that also functions as a platform for building decentralized applications (dApps) and smart contracts.

Additionally, many projects issue their own tokens, which are often used for specific purposes within a network. Tokens can represent assets, access rights, or governance powers, and they typically exist on top of an existing blockchain like Ethereum.

How Does Cryptocurrency Work?

Now that we’ve explored the key concepts, let’s break down how cryptocurrency works in practice:

1. Creation of Cryptocurrency: Mining and Supply

The process of creating cryptocurrency is known as mining. In the case of Bitcoin, mining involves solving complex mathematical problems to validate transactions and add them to the blockchain. Once a miner successfully solves the problem, a new block is created, and the miner is rewarded with newly created bitcoins.

The total supply of many cryptocurrencies is capped, which ensures that the currency remains scarce. For example, Bitcoin has a maximum supply of 21 million coins, which limits inflation and increases the potential value of the cryptocurrency over time.

2. Transactions: Sending and Receiving Cryptocurrency

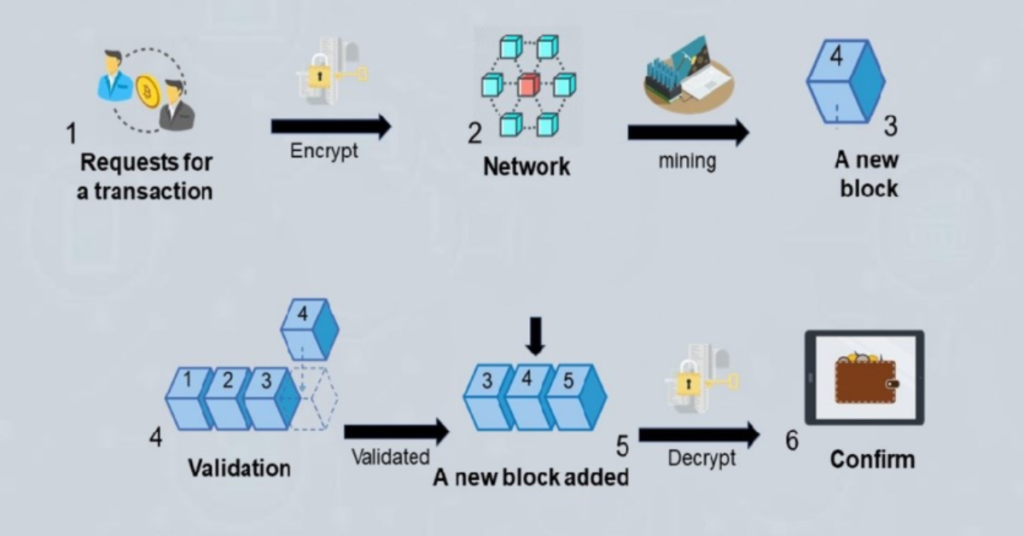

When you want to send cryptocurrency to someone, you need to know their public address. This is similar to a bank account number, where you can send funds. The transaction is broadcast to the network, and the miners or validators verify the details of the transaction.

Once the transaction is validated and confirmed, it is recorded on the blockchain, and the sender’s balance is updated. Because the blockchain is decentralized, no central authority is involved in the transaction, which can result in faster and more efficient transfers compared to traditional banking systems.

3. Security of Cryptocurrency: Blockchain’s Role

Blockchain plays a vital role in securing cryptocurrency transactions. Each block in the blockchain contains a record of multiple transactions, and the blocks are linked to one another through cryptographic hashes. This linkage ensures that once a block is added to the blockchain, it is nearly impossible to alter without changing every subsequent block, which would require the consensus of the network.

Because blockchain is decentralized, there is no central authority that can manipulate or reverse transactions. This makes cryptocurrency transactions highly secure and resistant to fraud or tampering.

4. Consensus Mechanisms: Proof of Work vs. Proof of Stake

Cryptocurrencies use consensus mechanisms to validate transactions and ensure that the blockchain remains secure. Two of the most common consensus mechanisms are Proof of Work (PoW) and Proof of Stake (PoS).

- Proof of Work (PoW): This mechanism requires miners to solve complex mathematical puzzles in order to validate transactions and add new blocks to the blockchain. It is used by Bitcoin and other cryptocurrencies. While PoW is highly secure, it is also energy-intensive and has been criticized for its environmental impact.

- Proof of Stake (PoS): In PoS, validators are chosen to create new blocks based on the amount of cryptocurrency they hold and are willing to “stake” as collateral. PoS is more energy-efficient than PoW and is used by cryptocurrencies like Ethereum 2.0.

5. Using Cryptocurrency: Storage and Spending

Once you own cryptocurrency, you can choose to either store it in a wallet for future use or spend it on goods and services. Cryptocurrencies are increasingly being accepted by merchants worldwide, and they can be used for everything from purchasing products online to paying for services like travel and entertainment.

While many people view cryptocurrency as an investment, it can also be used as a medium of exchange. The decentralized nature of cryptocurrencies allows individuals to send money directly to one another without needing a bank, which can be especially valuable in regions with limited access to traditional financial services.

Why is Cryptocurrency Important?

Cryptocurrency has gained immense importance for several reasons:

1. Financial Inclusion

Cryptocurrency can provide financial services to people who are excluded from traditional banking systems, especially in underdeveloped regions where access to banks is limited. As long as individuals have internet access, they can use cryptocurrencies for payments and savings.

2. Security and Transparency

Blockchain ensures that all cryptocurrency transactions are secure and transparent. Once a transaction is added to the blockchain, it cannot be altered, ensuring that the records are tamper-proof.

3. Investment Opportunities

Cryptocurrency has emerged as a popular investment option, with many seeing it as a hedge against inflation or as an alternative to traditional investment assets. Cryptocurrencies like Bitcoin have seen explosive growth in value, attracting investors looking for high returns.

4. Disruption of Traditional Financial Systems

Cryptocurrencies have the potential to disrupt traditional financial systems by offering a decentralized alternative to banks and financial institutions. This has led to the development of decentralized finance (DeFi) platforms, which offer banking services like lending, borrowing, and trading without intermediaries.

Conclusion

Cryptocurrency operates through the use of blockchain technology, cryptography, and decentralized networks, which together provide a secure and efficient way to conduct digital transactions. By eliminating the need for intermediaries like banks, cryptocurrencies offer a more transparent, secure, and accessible financial system. As the cryptocurrency ecosystem continues to evolve, it is poised to reshape the global economy in profound ways.

Understanding how cryptocurrency works is essential for anyone interested in participating in this rapidly growing space. Whether you’re looking to invest, use cryptocurrency for transactions, or simply learn about the technology behind it, grasping the basics of how it works is the first step toward engaging with this revolutionary financial tool.